What New First-Time Homebuyer Programs Save You Thousands?

There are many First-Time Home Buyer programs currently out there but some of them might not be worth it for you.

The first half of this article will focus on the most controversial one and at the end, you’ll see other programs to consider.

As of September 2019, The federal government released a special program intended to make homeownership more affordable (and in Spring 2021 the program will be expanded) for young people by introducing the First-Time Home Buyer Incentive (FTHBI) - but is it worth it?

As someone who might be self-employed or if you are friends with an entrepreneur, you’ll likely appreciate a similar scenario when I was on CBC’s Dragons’ Den. Like the government, the Dragons’ wanted to inject capital in my venture to allow us to afford to be an entrepreneur for longer, and with faster growth. But it came at a cost. They wanted large chunks of our company for a smaller value than I thought we were worth - this is why we said no. As we continued to work hard and grow the value of our early venture, they would come along for the ride.

Similarly, the government can be your investor and help you own home faster, but they’ll also be along for the ride and will enjoy a large chunk of money when you sell your home at what many can argue will be much higher than what you got today.

This $1.25 billion First-Time Home Buyer Incentive program, involves the government buying equity stakes in homes purchased by qualified home buyers, allowing for smaller mortgages that will keep monthly payments lower.

This program is administered by Canada’s housing agency, Canada Mortgage and Housing Corp. (CMHC). CMHC pays 5% of the purchase price for an existing home and up to 10% for the value of a new home in exchange for an equity stake. Once you as the homeowner sell the house, you’re obligated to repay the CMHC with 5% of the new home value.

See video explanation below:

The fine print:

Only for first-time homebuyers

You must have a down payment of at least 5% of the total purchase price, no higher than 20% which is the threshold of insured mortgages that they require

The household’s income must be under $150,000 (increased from $120,000), and the mortgage and incentive amount combined cannot be more than 4.5 times the household income.

As of May 2021, the maximum house value you would be able to apply for is $722,000 (see how you may qualify)

You must repay the loan after 25 years or when you sell the house, whichever comes first. You can also repay the loan at any point before that with no penalty.

USE THEIR CALCULATOR HERE TO DETERMINE YOUR ELIGIBILITY.

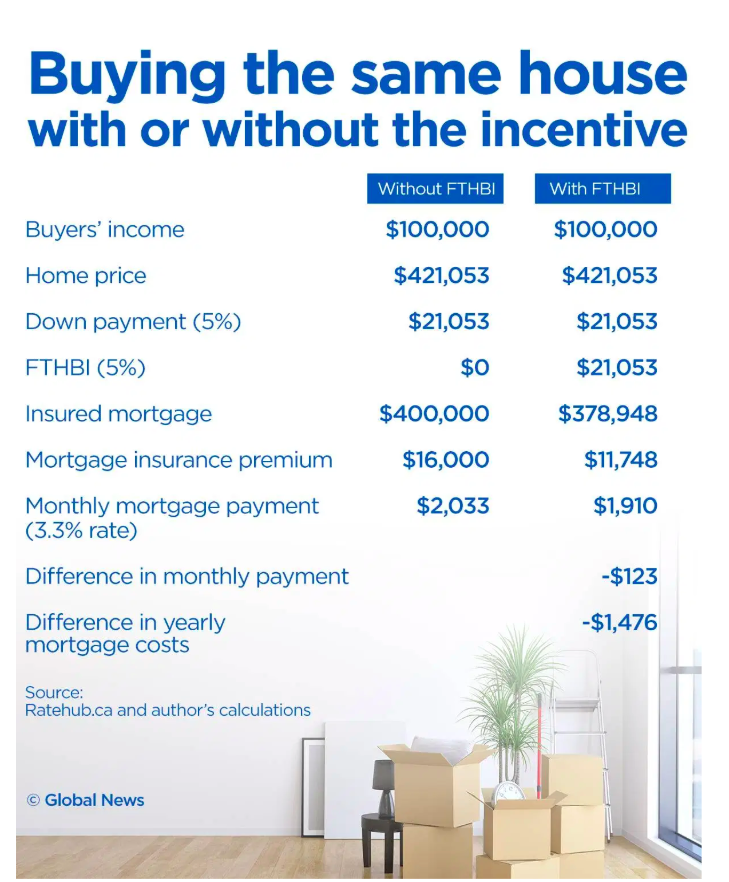

Example:

Reference: https://globalnews.ca/news/5398742/first-time-home-buyer-inventive-good-deal/

Why it may not be worth it

If you make $100,000, the most expensive home you could hope to buy with the incentive would be worth $421,053.

For example, let’s say our buyer who makes $100,000 a year repays the five percent incentive after 25 years and that his home has been appreciating at an annual rate of three percent — in line with the long-run average appreciation rate of real estate — over that period.

The house is now worth $881,591. If the buyer must return five percent of that to the government, as in the numerical examples provided by Ottawa, the payback works out to around $44,000. That would be more than the $36,900 the buyer would save in monthly mortgage payments thanks to the incentive, assuming his mortgage rate remains constant.

When it may be worth it

If in your circumstance you cannot contribute a 20% down payment or more to avoid mortgage insurance and you want to use extra capital for other expenses, this program might work for you. Taking the same example of a $100,000 HHI and ~$420,000 home price, you can save around $30,000 in interest and mortgage insurance charges by utilizing the government’s incentive (see more examples here). Especially if you’re not bullish on the appreciation of the housing market then this program could really be worth it for you as in the future you could pay the government less than their initial deposit if the market was to go down.

February update: The program is off to a slow start in the first 4 months.

https://www.canadianmortgagetrends.com/2020/02/cmhcs-first-time-home-buyer-incentive-off-slow-start/

Other First-Time Home Buyer Programs

1. Home Buyers RRSP Plan*

Can withdraw up to $35,000 from your RRSPs (up to $70,000 if 2nd buyer on title)

Must be in RRSP account for 90 days prior

Must be returned within 15 years (interest free)

*This is a federal program and they have a different definition of what a first-time home buyer is so check out this 1 minute video to see if you qualify even if you have bought a home before.

2. GST/HST New Housing Rebate

You may qualify for this rebate allowing to recover part of the GST or HST that you paid on the purchase price or cost of building your new house, on the cost of substantially renovating or building a major addition onto your existing house, or on converting a non-residential property into a house. See the GST/HST New Housing link which provides all of the details on this rebate.

BC: 36% Rebate of 5% GST

To qualify for the maximum Rebate, the purchase price of a new or presale home must be $350,000 or less, and the property must be a principal residence. If you do the math, a $350,000 home has the maximum rebate of $6,300.

Example:

$350,000 x .5% = $17,500

17,500 x 36% = $3,600

Partial GST Rebate

To qualify for the Partial Rebate, the purchase price of a new or presale home must be more than $350,000 and less than $450,000, and the property must be a principal residence. The rebate is gradually reduced and is calculated by using the following formula:

$6,300 x [$450,000 – the qualifying purchase price] / $100,000

Example on $425,000 Home

$6,300 x [$450,000 – $425,000 / $100,000] = $1,575

No GST Rebate applies if the property purchase price is above $450,000.

Ontario: Up to $24,000

Any pre-sale and new construction home is subject to HST. As per this article, in the summer of 2010, new home buyers in Ontario were charged 13% HST on their purchase, which consists of a 5% federal tax and 8% provincial tax. The new house HST rebate in Ontario rebates 75% of the Ontario portion of the HST, up to a new home purchase amount of $400,000. This results in a maximum rebate at a provincial level of $24,000 ($400,000 x 0.08 x 0.75). This is called the Ontario New Residential Rental Property Rebate (NRRPR).

3. Property Transfer Tax Housing Rebate

BC:

The First Time Home Buyers' Program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. Your home must be worth under $500,000 to qualify amongst other criteria.

The property must:

Only be used as your principal residence

Have a fair market value of $500,000 or less ($750,000 or less for Pre-Sales)

Be 0.5 hectares (1.24 acres) or smaller

You may qualify for a partial exemption from the tax if the property:

Has a fair market value less than $525,000 ($750,000 and less than $800,000 for Pre-Sales)

Is larger than 0.5 hectares

Has another building on the property other than the principal residence

Ontario:

Beginning January 1, 2017, no land transfer tax would be payable by qualifying first‑time purchasers on the first $368,000 of the value of the consideration for eligible homes. First‑time purchasers of homes greater than $368,000 would receive a maximum refund of $4,000.

4. Home Buyers' Amount

To assist first-time homebuyers with the costs associated with the purchase of a home, which includes legal fees, disbursements and land transfer taxes, the Government of Canada introduced a tax credit for first-time homebuyers in 2009.

How it works

A $5,000 non-refundable income tax credit amount on a qualifying home acquired during the year.

For an eligible homebuyer, the credit will provide up to $750 in federal tax relief. To find out if you are eligible, please visit the Home Buyers’ Amount webpage.

5. Other first-time home buyer grants

There are a lot more programs to check out through this article.

The government is stepping up to control hot real estate markets in Canada and help more people become homebuyers but it’s clear that you need to still exercise your personal finance and business acumen with your mortgage broker to crunch the numbers and scenarios in relation to your unique risk tolerance and trajectory.

When can you expect to get some of these subsidies back?

There is no retroactive refund on PTT as this is settled on closing day. You qualify for an exemption or you don’t and therefore, you pay (or do not pay) the tax with your lawyer on the day of closing - please make sure to align with your lawyer on this prior. GST is similar in terms of how it is paid as part of the purchase price upon closing however, if you qualify for a GST tax subsidy, you are on a CRA timeline of when you file your taxes.

See what you qualify for and contact Paul to get your pre-approval.

Paul Davidescu (www.levelupmortgages.com)

Level Up Mortgages

604-809-3188

paul(at)levelupmortgages.com

See Our Google Reviews in BC & Ontario: https://bit.ly/ViewLUMReviews ⭐️⭐️⭐️⭐️⭐️